Lots of noise has been made recently about rising interest rates and the uncertainty surrounding house prices.

Over the last two-year house prices have surged to record highs in every corner of the country and until recently, lenders offered very cheap borrowing by way of products with low interest rates.

Since the beginning of the year, interest rates have interest rates have increased considerably from record lows; where rates could previously be seen as low as under 1% whereas now the cheapest fixed rates available in todays market are over 3%. The reason that rates have increased is due to an increase in swap rates (rates at which the banks lend to and borrow from one another. Put simply, it now costs the bank more to lend people money, so in response, they increase the rates that they provide to consumers.

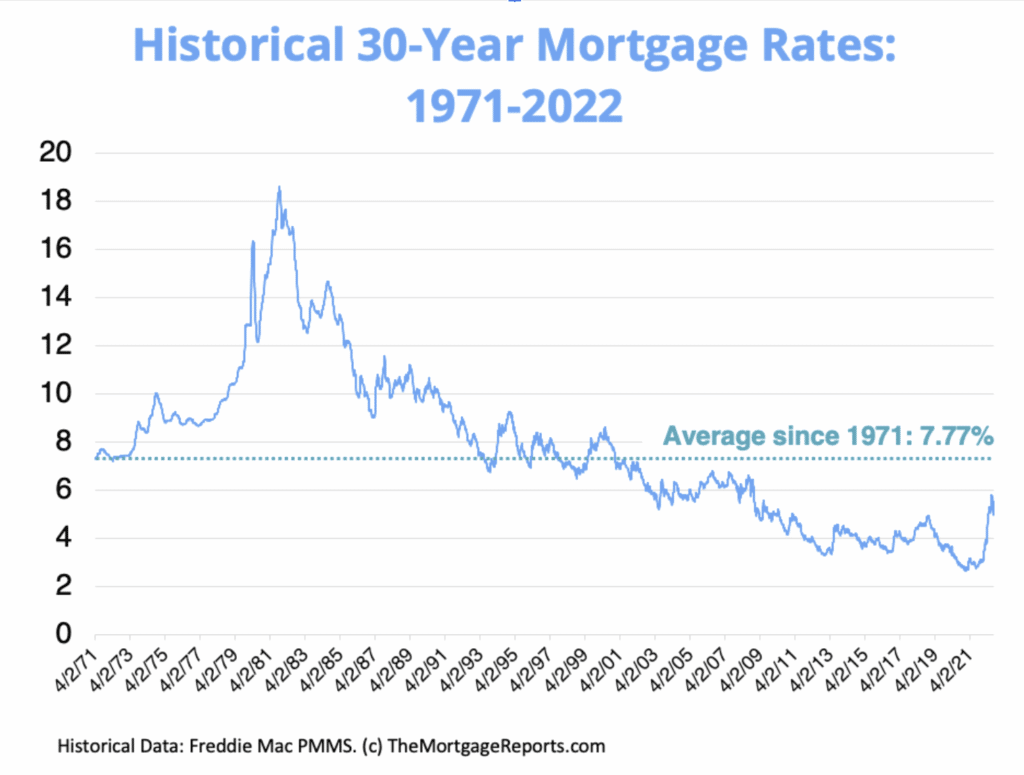

Whilst an increase in rates, and the subsequent increase in monthly mortgage payments naturally leads to people becoming more cautious when considering whether to borrow, it’s important to step back and look at a longer time frame to fully gauge where the market is and not get lost in media speculation.

In the above chart, we can see historic 50-year mortgage rates from 1971 to 2022. When we broaden our time horizon to cover this period, we can actually see that today’s rates are still well below the average of 7.77%. Whilst we are clearly going through a period of pain as the cost of living continues to increase, it can be argued that today’s rates aren’t that uncompetitive when you consider that rates in the last few years have literally been the lowest ever recorded in history. This period of cheap borrowing was highly unusual, potentially unsustainable.

There are lots of predictions floating around about what is going to happen to the economy next. Many are expecting a downturn, turning into a recession in the coming months and as a result we are starting to hear that the rate at which property prices are increasing is not as fast as it has been since 2019.

This is leading to people questioning whether now a good time is to buy. Should you wait until prices are cheaper? What are the chances of losing money if you decided to go ahead and buy now?

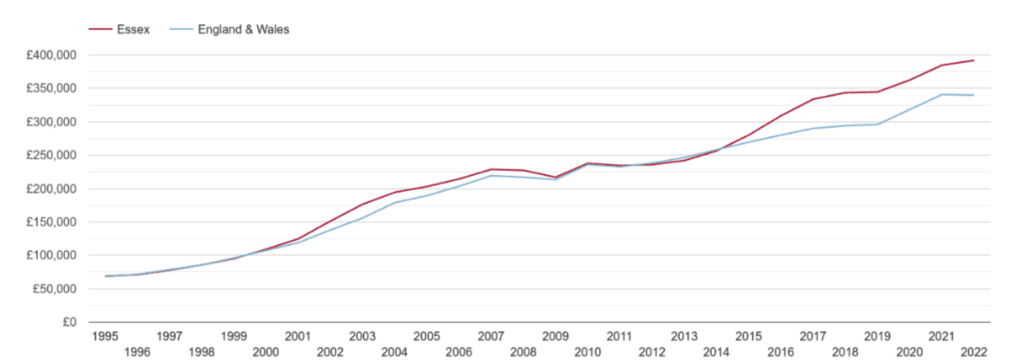

If we again expand our view over a long-time frame, we can quite clearly see that house prices have soared throughout that time. The only real downturn in that period, around the credit crisis of 2009, appears as nothing more than a slight blip in the grand scheme of things. In Essex specifically, growth has been even stronger in recent years and are still growing whilst the England and Wales average is starting to stagnate.

In the U.K homeownership is a fundamental part of the way people live and want to live not just another aspect of our economy. As such people overall are buying a property as a home in which they will spend on average 12 years living in, according to an article by Property Reporter. As we have noted from the graph above showing property price trends over this period anybody buying will see a steady increase in the value of their investment. Whilst affordability of course is key at any time, it is of course very relevant at present with what is going on in the economy but the reason we are still seeing positive activity in the housing market is due to the fact people first and foremost are buying a home in which they will live for years to come not just an asset.

No one has a crystal ball and there are to many variables for anyone to know where the market will go but a common saying in investing is ‘don’t try to time the market’. Essentially, the thought process here is that if you try to time the market and buy at a lower price, you may miss out and end up paying more than you otherwise would. Whilst there will always be changing markets to the economy and interest rates, we are in a country with a growing population and a housing stock that is significantly behind where it needs to be to fulfil the aspirations of those that need to buy or rent. Therefore, as shown in the graphs above, there will be a continuing overall upward trend.

If you are in the market to buy or refinance a property, speak to the professionals. Mortgage Advisers will advise you to the best of their ability and guide you through the process by providing you with a structure that helps you achieve your goals.